Holder And Holder In Due Course

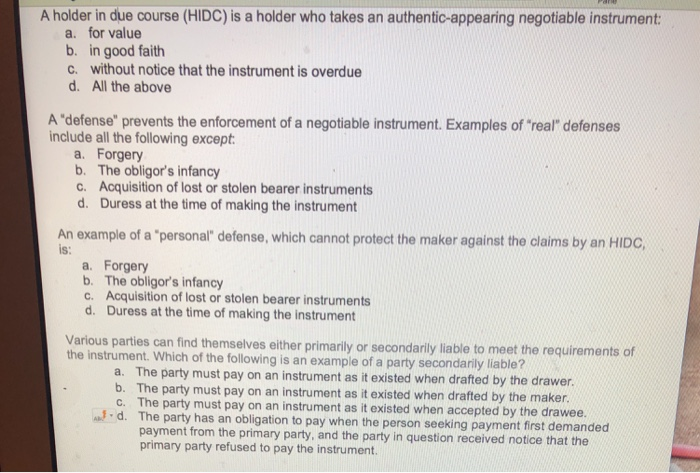

A holder in due course is a holder who has taken the instrument under the following conditions: (a) That it is complete and regular upon its face; (b) That he became the holder of it before it was overdue, and without notice that it has been previously dishonored, if such was the fact.

In commercial law, a holder in due course is someone who accepts a negotiable instrument in a value-for-value exchange without reason to doubt its legitimacy. A holder in due course acquires the right to make a claim for the instrument's value against its originator and intermediate holders. Even if one of these parties passed the instrument in bad faith or in a fraudulent transaction, a holder in due course may retain the right to enforce it. Advanced systemcare 12 pro discount coupon.

Rights[edit]

The rights of a holder in due course of a negotiable instrument are qualitatively, as matters of law, superior to those provided by ordinary species of contracts:

- The rights to payment are not subject to set-off, and do not rely on the validity of the underlying contract giving rise to the debt (for example if a cheque was drawn for payment for goods delivered but defective, the drawer is still liable on the cheque).

- No notice need be given to any party liable on the instrument for transfer of the rights under the instrument by negotiation. However, payment by the party liable to the person previously entitled to enforce the instrument 'counts' as payment on the note until adequate notice has been received by the liable party that a different party is to receive payments from then on. [U.C.C. §3-602(b)]

- Transfer free of equities—the holder in due course can hold better title than the party he obtains it from (as in the instance of negotiation of the instrument from a mere holder to a holder in due course)

- Negotiation often enables the transferee to become the party to the contract through a contract assignment (provided for explicitly or by operation of law) and to enforce the contract in the transferee-assignee’s own name. Negotiation can be affected by endorsement and delivery (order instruments), or by delivery alone (bearer instruments). In addition, the rights and obligations accruing to the transferee can be affected by the rule of derivative title, which does not allow a property owner to transfer rights in a piece of property greater than his own.

Limitations[edit]

The rule can be considered inequitable to consumers. As a response to this, the U.S. Federal Trade Commission promulgated Rule 433, formally known as the 'Trade Regulation Rule Concerning Preservation of Consumers' Claims and Defenses', which 'effectively abolished the [holder in due course] doctrine in consumer credit transactions'.[1] In 2012, the FTC reaffirmed the regulation.[2]

References[edit]

- ^Commercial Paper: Holder in Due Course & DefensesArchived 2012-11-28 at the Wayback Machine.

- ^'FTC Opinion Letter Affirms Consumers' Rights under the Holder Rule'. web.archive.org. 2012-05-14. Retrieved 2019-05-22.

noun

RELATED CONTENT

Nearby words